Financial technology corporations, and ordinary people, are all driven to employ AI. Intelligent software helps businesses and people make more money by removing. Needless expenses and improving the convenience of handling finances. This article will provide you with information about. The market circumstances, leading rivals, and lucrative niches in AI-centric financial software growth, along with guidance on potential hazards. If you're wanting to break into this field.

Fintech with AI: a market over view

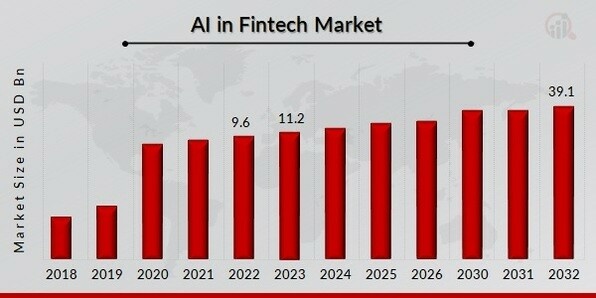

Let's start by taking a broad look at the market environment to determine whether it is conducive to newcomers. The fintech industry's global market for artificial intelligence is expected to grow to $61.3 billion by 2031.

This remarkable number is the result of multiple factors:

-

The efficacy of the method

Fintech greatly boosts productivity through the effective application of AI. Since artificial intelligence is so valuable. It may result in less work being done on data entry and more accurate credit rating tracking. There's little doubt that this will encourage more adoption.

-

The global health

As a result, modern technology was also extensively embraced. The epidemic of COVID-19. the subsequent changes in work practices and government activities. Businesses using AI technology are only more productive when lockdowns are in place.

lso read : Top 5 Fintech Companies in New York City (NYC)

Who needs AI in fintech 2023

In terms of the financial digital transformation. The following areas see the greatest application of AI and ML (machine learning).

-

The protection

Every year, banks lose billions of dollars due to fraud. Thankfully, AI has improved a company's ability to identify suspicious activity and strengthen cybersecurity.

-

The Savings

Almost $4.6 trillion worth of assets are managed by automated advisers worldwide. Furthermore, customers have additional trading options thanks to innovative websites like Vino vest unities for users.

-

Speed.

AI-based software has a wide range of applications and a track record of success when. It comes to enhancing data processing or taking over clerical activities like.

-

client support

AI and ML-enabled chatbots save businesses money while also helping users.

Top 5 Fintech AI Technologies for 2023

The most prominent AI-infused finance products are:

-

AI Axyon

This Italian startup provides a platform for investment management called IRIS. They work with hedge funds, commodity traders, and asset managers, and their partners include Microsoft, IBM, and Nvidia. Funding for Axion comes from funds from the European Union and venture capitalists totaling €1.6 million ($1.77 million).

-

In the forward lane

With the use of AI, Forward Lane offers a financial analytics system. that can be integrated with CRMs and provides guidance on client interactions. It mainly targets asset management companies and brokers, utilizing natural language processing (NLP) techniques. Salesforce, Microsoft Dynamics, and Thomson Reuters are partners of Forward Lane. Venture funding worth $8.6 million has been invested in the company.

-

Metrics for Tokens

This business bills itself as "the Bloomberg for crypto," and it succeeds. In fact, Token Metrics produces a slate of original financial TV programs. However, its primary product is a big data and fintech-integrated bitcoin market platform. Token Metrics received funding of $4.5 million from equity crowdfunding and venture funds.

-

The aida

This Singaporean company helps underwriters manage insurance claims. keeping fraud at bay and providing excellent customer service. Several prominent investors, MasterCard among them, have given it a substantial sum of venture cash.

-

Active.ai

This business develops cutting-edge chatbots for financial services firms. It provides customized solutions for financial markets, B2B/B2C banking, insurance, and Visa, among other things. Over six rounds, Active.ai raised close to $15 million in venture money.

Also read : Crypto fintech Oobit names Phillip Lord as president

Which fintech markets are still open to new newcomers?

The fact that there is still room for new competitors in the AI-based fintech market contributes to its continued growth.

-

online banking

Established banking organizations are under pressure from rivals striving for the top position. Nedbanks often offer higher interest rates, lower fees, and more transparency in the flow of funds.

-

robotic life coaches

Millennials are particularly fond of this kind of software due to its accessibility and ease of use. The need for AI-driven advice is growing now that this generation is responsible for managing finances.

-

The regtech

It takes time and is prone to human mistake to prepare all the required papers and stay up to date with the regulations. Because of this, investing in automated compliance software is highly worthwhile.

-

service of financial records

keeping an eye on outstanding invoices, bank accounts, and tasks. This set of applications makes managing personal finances easier. additional assets and responsibilities.

AI's advantages in the financial industry

Fintech and AI go together like clockwork. This is the explanation.

Gains for bank institutions

AI will enable fintech companies to grow in the following ways:

-

The Cost-saving

Artificial intelligence saves cost on customer service. Avoiding fraud, reassigning office duties, and other related costs.

-

The greater customer service

Younger generations, including millennials, are far more tech-savvy. They find it natural to use it, therefore digital services are not only necessary but also a convenience. Improved UX has a significant role in the success of AI-driven fintech since recurring business is crucial.

-

The great data

Algorithms with proper training can perform as well as or better than human analysts. But unlike people, you can examine an AI's internal workings to determine the precise process by which a judgment was made.

Also read : 10 Secrets to Starting an Ecommerce Business from Scratch in 2023

The Improvement of the user's experience

Customers benefit from ai in fintech 2023 as well:

-

Access

Robo-advisors and new banks are accessible to a considerably larger market. While many human advisors have a minimum balance on an account requirement of $100,000, the former pay smaller fees.

-

Easy access

If you have a phone and an internet connection, you can use fintech apps anywhere. Chatbots are designed to provide prompt solutions to frequent questions and concerns.

-

The Personal finance and accounting

Ten years ago, only the wealthy could afford to see a financial counselor. Anyone may carry bill tracking, investing chances, and market statistics in their palm these days.

Conclusion

2023 is the ideal year to enter the fintech sector due to the rising demand and investment. Yes, it takes a lot of work to maintain compliance with regulatory requirements, secure user data, and build a strong reputation. But overcoming this challenge would be lot simpler if you work with a dependable development partner like EPAM Startups & SMBs.

Also read : Applying Data and Metrics to Improve Cyber Security Planning 2023.