Overseeing individual funds successfully is vital for accomplishing monetary steadiness and assembly your life objectives. With the rise of fintech — budgetary innovation — apps have revolutionized how we track investing, spare cash, contribute, and budget. These apps make individual back administration available, natural, and effective for everybody, Best fintech apps for personal finance management.

In this blog, we investigate a few of the best fintech apps in 2025 that can offer assistance you take control of your cash with shrewd highlights, user-friendly interfacing, and cutting-edge technology.

Read Also: How Fintech Is Changing the Financial Industry?

Why Utilize Fintech Apps for Individual Finance?

Traditional strategies of overseeing cash, such as spreadsheets or pen-and-paper budgeting, can be repetitive and error-prone. Fintech apps offer mechanization, real-time upgrades, and personalized experiences that streamline these errands. Here’s why fintech apps stand out:

Automation: Naturally track your costs, bills, and wage without manual entry.

Insights: Utilize AI-driven analytics to get it investing designs and optimize budgets.

Accessibility: Oversee accounts anytime, anyplace, on versatile or web platforms.

Goal Setting: Set and track investment funds or obligation reimbursement objectives with motivational reminders.

Investment Integration: A few apps give consistent integration with speculation portfolios.

Security: Most fintech apps utilize bank-level encryption and security protocols.

Top Fintech Apps for Individual Back Management

1. Mint

Mint by Intuit is one of the most prevalent and trusted individual fund apps around the world. It offers a comprehensive diagram of your money related life by connecting your bank accounts, credit cards, bills, and ventures in one place.

Key Features:

Automatic cost categorization

Budgeting instruments with alerts

Bill following and reminders

Free credit score monitoring

Customizable monetary goals

Mint’s natural dashboard makes it simple to see where your cash goes and how to optimize your spending.

2. YNAB (You Require A Budget)

YNAB is perfect for those who need to get genuine approximately budgeting and budgetary teach. Its logic spins around giving each dollar a work, making a difference clients arrange ahead and maintain a strategic distance from debt.

Key Features:

Real-time budget tracking

Goal-based budgeting

Syncs with bank accounts securely

Educational assets and community support

Reports for net worth and investing trends

While YNAB requires a membership, numerous clients discover its approach profoundly successful in picking up monetary control.

3. Individual Capital

Personal Capital combines budgeting with strong venture following, making it idealize for those interested in both cost administration and Best fintech apps for personal finance management.

Key Features:

Expense following and budgeting

Retirement organizer and speculation checkup

Net worth tracker

Cash stream analyzer

Fee analyzer for investments

This app is especially valuable for clients who need to adjust their regular funds with long-term venture goals.

4. PocketGuard

If you’re looking for a basic and direct app that tells you how much cash you can securely spend, PocketGuard is a incredible choice.

Key Features:

Tracks pay, bills, and costs automatically

"In My Stash" include appears spendable cash after bills and goals

Budgeting made basic with investing limits

Bill transaction benefit (premium feature)

Savings objectives and advance tracking

PocketGuard is idealize for clients who need fast experiences without as well numerous chimes and whistles.

5. Goodbudget

Goodbudget is a advanced envelope budgeting framework that makes a difference you designate reserves into categories, comparable to utilizing cash envelopes.

Key Features:

Envelope budgeting method

Syncs over gadgets for family budgeting

Expense following and planning

Reports and advance charts

Simple manual passage (no bank sync)

Ideal for couples or families who need to share a budget and adhere to a taught plan.

You May Also Like: How Much Does Fintech Pay in Southwest Florida Roblox?

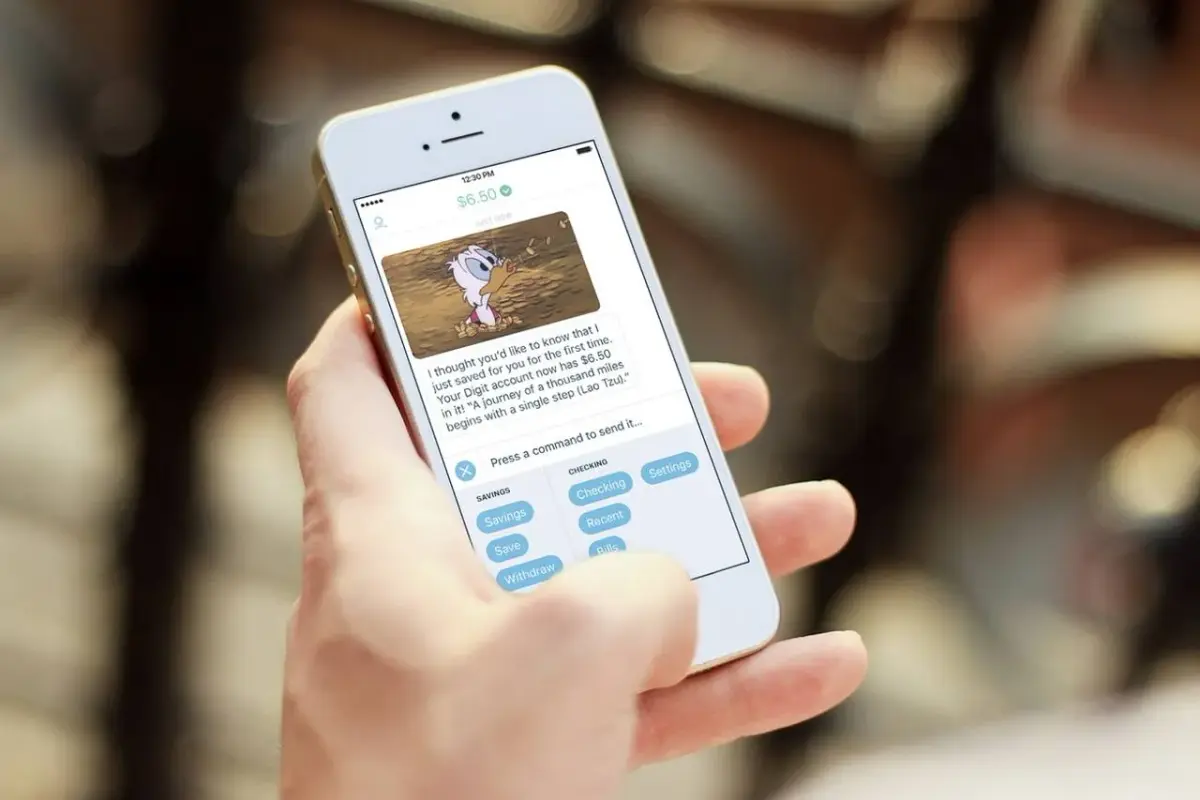

6. Acorns

Acorns is a micro-investing app that rounds up your ordinary buys to the closest dollar and contributes the save alter consequently. It’s a special mix of investment funds, contributing, and individual back management.

Key Features:

Automatic round-ups for micro-investing

Portfolio administration based on hazard tolerance

Retirement account options

Found Cash cashback offers from accomplice brands

Educational substance for unused investors

Acorns is incredible for apprentices needing to begin contributing without complex setups.

7. Simplifi by Quicken

Simplifi offers a advanced approach to individual back with personalized experiences and simple objective tracking.

Key Features:

Customizable investing watchlists

Automatic categorization of transactions

Real-time adjust updates

Bill updates and forecasting

Goal setting with advance visualization

Simplifi is outlined for active individuals who need a clear monetary preview with negligible effort.

How to Select the Right Fintech App?

Choosing the best app depends on your monetary objectives, way of life, and inclinations. Consider these factors:

Budgeting Needs: Do you need strict budgeting (YNAB) or casual following (PocketGuard)?

Investment Integration: Are you interested in following or overseeing investments?

User Interface: See for instinctive and easy-to-navigate apps.

Security: Guarantee the app employments strong encryption and is compliant with regulations.

Cost: Numerous apps offer free forms, but premium highlights may require a subscription.

Tips for Maximizing Fintech Apps

Link all accounts: Interface bank accounts, credit cards, credits, and ventures for a full monetary picture.

Set reasonable objectives: Utilize app apparatuses to make achievable sparing, budgeting, or obligation payoff goals.

Review routinely: Check your funds week after week to spot patterns and alter your budget.

Use alarms: Empower notices for charge installments and overspending.

Educate yourself: Take advantage of in-app assets and community forums.

The Future of Fintech in Individual Finance

With AI and machine learning getting to be standard, fintech apps will proceed to offer more personalized budgetary counsel. Anticipate highlights like mechanized assess optimization, superior extortion discovery, and progressed investing expectation to gotten to be standard. Open keeping money will moreover make syncing over money related educate simpler and more secure.

Conclusion

Fintech apps have changed individual fund administration from a chore into an enabling involvement. Whether you need to budget way better, spare more, contribute shrewdly, or basically get it your cash propensities, there’s a fintech app custom-made for you.

Try out one or more of the apps recorded over to discover the one that fits your fashion and objectives. With the right instruments, overseeing your individual accounts can be simpler, more astute, and indeed pleasant!