A year ago, Mike Butcher reported that Faye hopes to do for travel insurance what Lemonade did for unstipulated insurance, and that’s as good a summary of what Faye does as anything. The visitor was kind unbearable to share its (lightly redacted) pitch deck with me so I could take a squint under the hood to see the narrative it wove to tropical its $10 million.

We’re looking for increasingly unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.�

Slides in this deck

Faye raised its Series A round with a 19-slide deck, a few of which have been lightly redacted to shield sensitive data from curious eyes:

- Cover slide

- Summary slide

- Team slide

- Problem slide

- Market-size slide

- Insurance market overview slide

- Product overview slide

- Product features slide 1

- Product features slide 2

- � Product features slide 3

- � Product features slide 4

- � Go-to-market slide

- � Financial growth metrics slide

- � Customer growth metrics slide

- � Customer validation slide 1

- � Competitive landscape slide

- � The Ask slide

- � Customer validation slide 2

- � Closing slide with mission statement

Three things to love

Let’s get this out of the way right off the bat: This is a truly spanking-new pitch deck. I’m going to add it to my rotation of decks that are unconfined examples of how to slaver a potentially ramified story into an easy-to-follow narrative.

Love a good summary slide

As I mentioned in my post well-nigh summary slides, the combination of the imbricate and summary slides sets the context for the rest of the conversation. Faye did a unconfined job with showing how a good, transitory slide can set the pace.

[Slide 2] Setting the pace. Image Credits: Faye

If we take all of the numbers at squatter value, the next step of the story is to convince investors that this is the right team to take on this market.

Which takes us to slide 3, the company’s team slide. Unfortunately, it isn’t that great, so we’ll talk well-nigh it in the “What could be improved” section later in this article. For now, let’s skip to flipside slide that did a unconfined job of subtracting to Faye’s story.

Great storytelling on the market-size slide

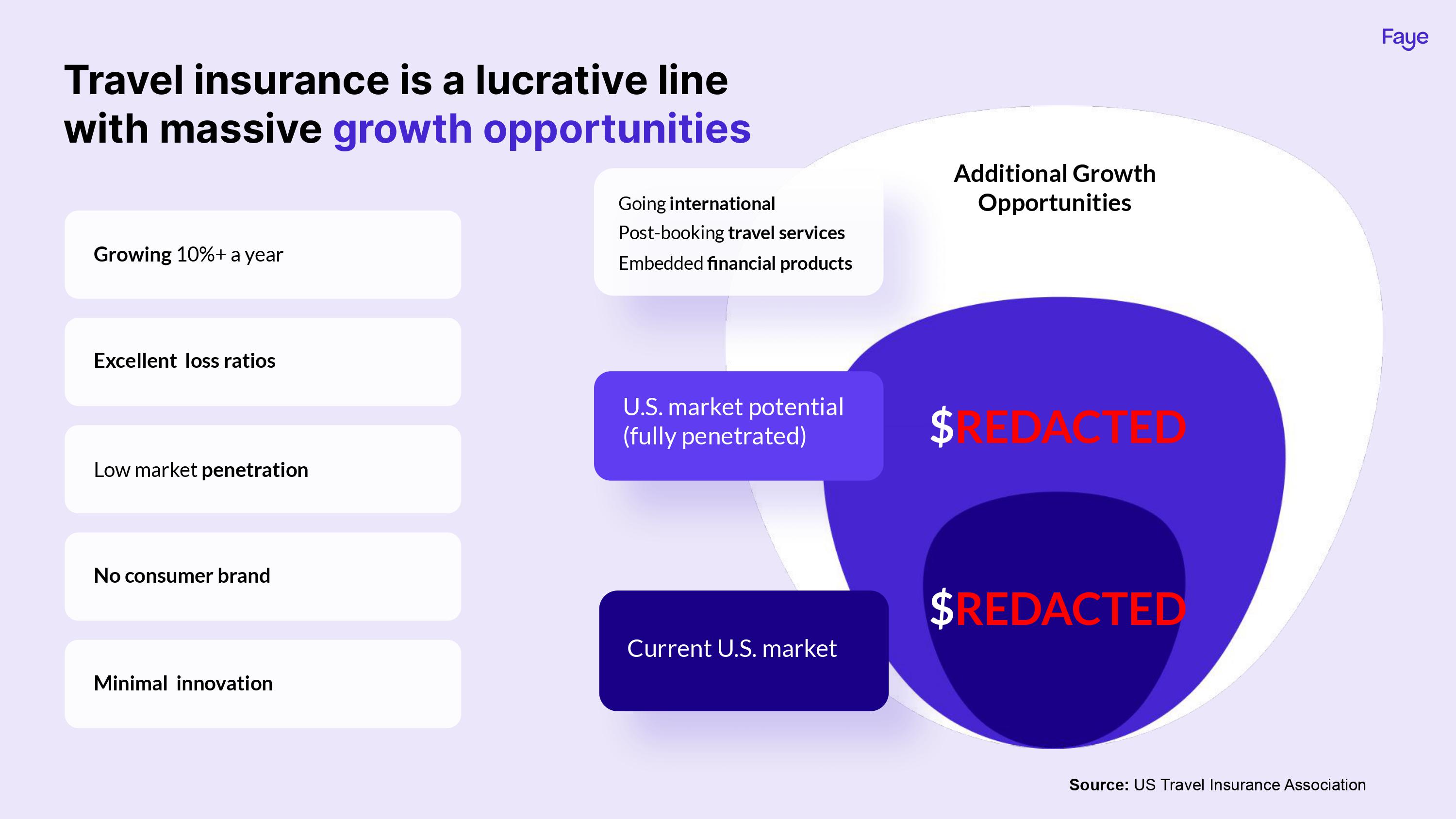

[Slide 5] What a unconfined way to use market sizing to your benefit. Image Credits: Faye

Faye numbers aside, this is a rare example of a market-sizing slide that moreover provides the rest of the context. I thought it was washed-up really well.

Showing that the market size is (presumably) huge, and then substantially saying, “But the TAM could be worthier by growing the service offering and international roll-out,” is very shrewd. It shows that there’s a unconfined opportunity misogynist right now and that the opportunity could grow further.

The data points on the left are excellent, too, as they contextualize the merchantry in the greater market.

This slide teaches us that you can tell a comprehensive story without muddling the message. I imagine the voice-over for this slide would be something withal these lines:

The market we are going without is $xx right now, and could be as big as $yy once we have fully addressed it. What’s truly heady here, however, is that the market is hands disrupted. There is little innovation, no recognized consumer brands, the brands that do operate have low market penetration, and the unshortened market is growing 10% year-on-year.

The narrative ties it all together, painting travel insurance as a very interesting opportunity.

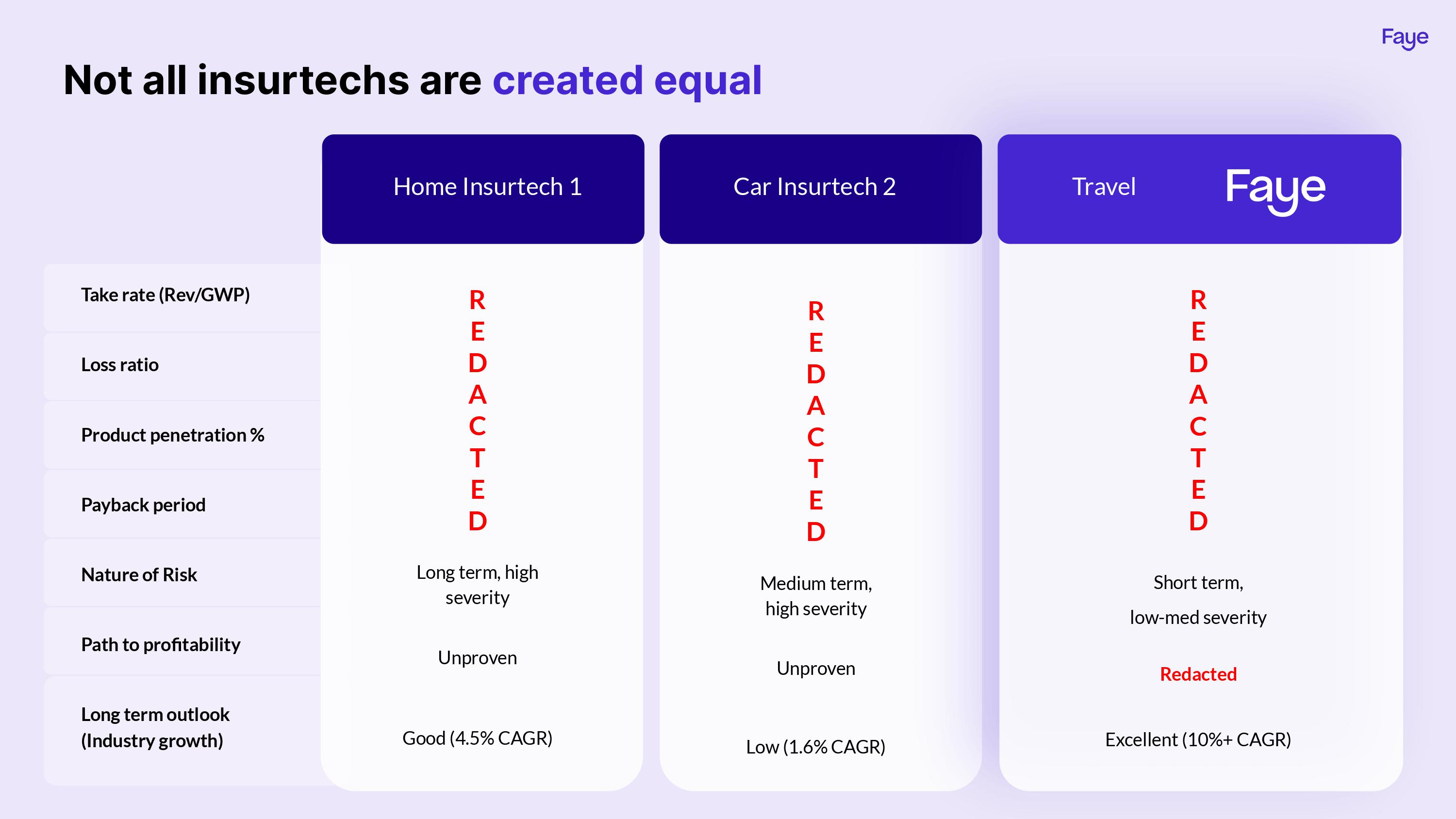

Intermarket comparison

Faye is targeting travel insurance, using some proximal markets (car and home insurance) as comparisons to show that travel insurance is a largest opportunity. Again, the numbers here are redacted, but as far as storytelling goes, this is a really good approach:

[Slide 6] Insurtech galore. Image Credits: Faye

In the rest of this teardown, well take a squint at three things Faye could have improved or washed-up differently, withal with its full pitch deck!